Are Investors Money Reflect In Income Statement

Introduction to Fiscal Statements

8 Draw the Income Statement, Statement of Owner'south Equity, Rest Sheet, and Argument of Cash Flows, and How They Interrelate

The written report of accounting requires an agreement of precise and sometimes complicated terminology, purposes, principles, concepts, and organizational and legal structures. Typically, your introductory accounting courses will familiarize you with the overall accounting surround, and for those of you who want greater detail, at that place is an assortment of more advanced accounting courses available.

This affiliate concentrates on the 4 major types of financial statements and their interactions, the major types of business structures, and some of the major terms and concepts used in this course. Coverage here is somewhat bones since these topics are accorded much greater detail in future capacity.

Types of Business concern Structure

As y'all learned in Part of Bookkeeping in Society, virtually every activity that occurs in a business has an associated cost or value. Part of an auditor'south role is to quantify these activities, or transactions.

Also, in business—and accounting in particular—information technology is necessary to distinguish the business entity from the private owner(south). The personal transactions of the owners, employees, and other parties connected to the business should not be recorded in the organisation's records; this accounting principle is chosen the business entity concept. Accountants should tape just business organization transactions in business records.

This separation is also reflected in the legal structure of the business. There are several common types of legal business organization structures. While the bookkeeping concepts for the diverse types of businesses are substantially the same regardless of the legal construction, the terminology volition modify slightly depending on the organization's legal structure, and it is important to understand the differences.

There are three broad categories for the legal structure of an organization: sole proprietorship, partnership, and corporation. A sole proprietorship is a legal business organization structure consisting of a single private. Benefits of this type of structure include ease of formation, favorable tax handling, and a high level of control over the business. The risks involved with sole proprietorships include unlimited personal liability and a limited life for the business. Unless the business is sold, the business ends when the owner retires or passes away. In improver, sole proprietorships take a fairly express ability to raise capital (funding), and frequently sole proprietors have limited expertise—they are excellent at what they practise just may have limited expertise in other important areas of business organization, such equally bookkeeping or marketing.

A partnership is a legal business construction consisting of an association of 2 or more than people who contribute money, belongings, or services to operate every bit co-owners of a business organization. Benefits of this type of construction include favorable tax handling, ease of germination of the business concern, and improve access to capital letter and expertise. The downsides to a partnership include unlimited personal liability (although there are other legal structures—a express liability partnership, for instance—to aid mitigate the hazard); limited life of the partnership, similar to sole proprietorships; and increased complexity to form the venture (decision-making authority, turn a profit-sharing organisation, and other important issues need to be formally articulated in a written partnership agreement).

A corporation is a legal business structure involving 1 or more individuals (owners) who are legally distinct (separate) from the business. A primary benefit of a corporate legal structure is the owners of the organisation have limited liability. That is, a corporation is "stand up alone," conducting business as an entity separate from its owners. Under the corporate structure, owners consul to others (chosen agents) the responsibility to make day-to-24-hour interval decisions regarding the operations of the business organisation. Other benefits of the corporate legal structure include relatively like shooting fish in a barrel admission to large amounts of capital by obtaining loans or selling buying (stock), and since the stock is hands sold or transferred to others, the business organisation operates across the life of the shareholders. A major disadvantage of a corporate legal structure is double taxation—the business organization pays income tax and the owners are taxed when distributions (also called dividends) are received.

| Types of Business Structures | |||

|---|---|---|---|

| Sole Proprietorship | Partnership | Corporation | |

| Number of Owners | Unmarried individual | Ii or more individuals | One or more owners |

| Ease of Formation | Easier to form | Harder to course | Hard to form |

| Ability to Raise Capital | Difficult to raise capital | Harder to raise capital | Easier to raise capital |

| Liability Gamble | Unlimited liability | Unlimited liability | Limited liability |

| Taxation Consideration | Single revenue enhancement | Single revenue enhancement | Double tax |

The Iv Fiscal Statements

Are you a fan of books, movies, or sports? If and then, chances are you have heard or said the phrase "spoiler alert." It is used to forewarn readers, viewers, or fans that the ending of a pic or book or outcome of a game is about to be revealed. Some people adopt knowing the end and skipping all of the details in the middle, while others prefer to fully immerse themselves so notice the outcome. People often practice not know or sympathise what accountants produce or provide. That is, they are non familiar with the "ending" of the bookkeeping process, but that is the best place to begin the study of accounting.

Accountants create what are known equally fiscal statements. Financial statements are reports that communicate the fiscal performance and financial position of the organization.

In essence, the overall purpose of financial statements is to evaluate the performance of a company, governmental entity, or not-for-profit entity. This chapter illustrates this through a company, which is considered to be in business to generate a turn a profit. Each fiscal argument we examine has a unique function, and together they provide data to determine whether a company generated a turn a profit or loss for a given period (such as a month, quarter, or year); the assets, which are resources of the visitor, and accompanying liabilities, which are obligations of the company, that are used to generate the profit or loss; owner interest in profits or losses; and the cash position of the company at the end of the period.

The four financial statements that perform these functions and the order in which nosotros prepare them are:

- Income Statement

- Statement of Owner's Disinterestedness

- Balance Sail

- Statement of Greenbacks Flows.

The gild of preparation is important equally it relates to the concept of how financial statements are interrelated. Before explaining each in particular, let's explore the purpose of each financial statement and its master components.

Introduction to the Gearhead Outfitters Story

Gearhead Outfitters, founded by Ted Herget in 1997 in Jonesboro, Arkansas, is a retail chain that sells outdoor gear for men, women, and children. The company's inventory includes clothing, footwear for hiking and running, camping gear, backpacks, and accessories, by brands such equally The Northward Face, Birkenstock, Wolverine, Yeti, Altra, Mizuno, and Patagonia. Herget fell in love with the outdoor lifestyle while working equally a ski instructor in Colorado and wanted to bring that feeling back abode to Arkansas. And and then, Gearhead was born in a small downtown location in Jonesboro. The company has had great success over the years, expanding to numerous locations in Herget's home land, besides every bit Louisiana, Oklahoma, and Missouri.

While Herget knew his industry when starting Gearhead, like many entrepreneurs he faced regulatory and fiscal issues that were new to him. Several of these issues were related to bookkeeping and the wealth of controlling information that accounting systems provide.

For example, measuring revenue and expenses, providing information about cash catamenia to potential lenders, analyzing whether profit and positive greenbacks flow is sustainable to allow for expansion, and managing inventory levels. Accounting, or the preparation of fiscal statements (balance canvass, income statement, and statement of cash flows), provides the mechanism for business owners such as Herget to make fundamentally sound business organization decisions.

Purpose of Fiscal Statements

Before exploring the specific fiscal statements, it is important to know why these are important documents. To empathise this, yous must first understand who the users of financial statements are. Users of the information plant in financial statements are called stakeholders. A stakeholder is someone affected by decisions made by a company; this can include groups or individuals affected past the actions or policies of an organization, including include investors, creditors, employees, managers, regulators, customers, and suppliers. The stakeholder's interest sometimes is not directly related to the entity'south financial performance. Examples of stakeholders include lenders, investors/owners, vendors, employees and management, governmental agencies, and the communities in which the businesses operate. Stakeholders are interested in the functioning of an organization for various reasons, but the mutual goal of using the financial statements is to understand the information each contains that is useful for making financial decisions. For example, a broker may be interested in the financial statements to decide whether or not to lend the system money.

Likewise, small business organization owners may brand decisions based on their familiarity with the business—they know if the business is doing well or not based on their "gut feeling." By preparing the financial statements, accountants can assist owners by providing clarity of the organization's financial performance. It is of import to understand that, in the long term, every activity of the business organisation has a financial affect, and financial statements are a way that accountants report the activities of the business. Stakeholders must brand many decisions, and the financial statements provide information that is helpful in the conclusion-making process.

As described in Role of Accounting in Society, the complete set of financial statements acts as an X-ray of a company's fiscal health. By evaluating all of the financial statements together, someone with financial cognition tin can decide the overall health of a company. The auditor can use this information to advise exterior (and inside) stakeholders on decisions, and direction tin can use this information equally one tool to make strategic brusque- and long-term decisions.

Utilitarian View of Bookkeeping Decisions and Stakeholder Well-Existence

Utilitarianism is a well-known and influential moral theory commonly used equally a framework to evaluate business decisions. Utilitarianism suggests that an ethical activeness is ane whose consequence achieves the greatest good for the greatest number of people. So, if we desire to brand an ethical conclusion, we should enquire ourselves who is helped and who is harmed by it. Focusing on consequences in this style generally does not crave united states to take into account the means of achieving that item end, all the same. Put simply, the utilitarian view is an ethical theory that the best action of a company is the one that maximizes utility of all stakeholders to the determination. This view assumes that all individuals with an interest in the business organization are considered inside the conclusion.

Financial statements are used to understand the financial performance of companies and to make long- and short-term decisions. A commonsensical approach considers all stakeholders, and both the long- and short-term furnishings of a business decision. This allows corporate decision makers to choose business deportment with the potential to produce the all-time outcomes for the bulk of all stakeholders, non just shareholders, and therefore maximize stakeholder happiness.

Accounting decisions tin change the approach a stakeholder has in relation to a business. If a company focuses on modifying operations and fiscal reporting to maximize short-term shareholder value, this could indicate the prioritization of certain stakeholder interests above others. When a company pursues but curt-term profit for shareholders, information technology neglects the well-being of other stakeholders. Professional accountants should be aware of the interdependent relationship between all stakeholders and consider whether the results of their decisions are expert for the bulk of stakeholder interests.

Business Owners as Conclusion Makers

Recall of a business owner in your family unit or community. Schedule some time to talk with the business owner, and find out how he or she uses financial information to make decisions.

Solution

Business owners volition apply financial data for many decisions, such as comparing sales from i period to another, determining trends in costs and other expenses, and identifying areas in which to reduce or reallocate expenses. This data will exist used to determine, for example, staffing and inventory levels, streamlining of operations, and advertising or other investment decisions.

The Income Statement

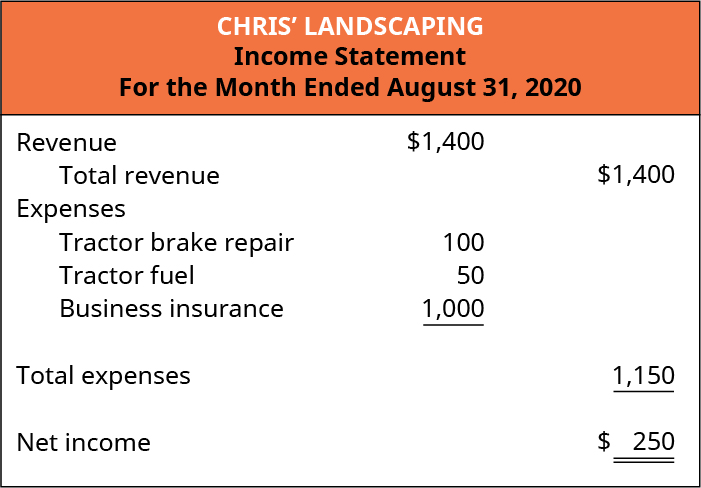

The beginning fiscal statement prepared is the income statement, a argument that shows the system'southward financial operation for a given menstruation of fourth dimension. Let's illustrate the purpose of an income statement using a real-life example. Assume your friend, Chris, who is a sole proprietor, started a summertime landscaping business organization on August 1, 2020. Information technology is categorized every bit a service entity. To keep this example simple, presume that she is using her family's tractor, and we are using the cash ground method of accounting to demonstrate Chris's initial operations for her business. The other available basis method that is commonly used in accounting is the accrual ground method. She is responsible for paying for fuel and any maintenance costs. She named the business organization Chris' Landscaping. On August 31, Chris checked the account rest and noticed there is just $250 in the checking account. This balance is lower than expected because she idea she had been paid by some customers. Chris decides to do some research to determine why the balance in the checking business relationship is lower than expected. Her research shows that she earned a full of $1,400 from her customers but had to pay $100 to fix the brakes on her tractor, $50 for fuel, and also made a $ane,000 payment to the insurance visitor for business insurance. The reason for the lower-than-expected residue was due to the fact that she spent ($1,150 for brakes, fuel, and insurance) simply slightly less than she earned ($ane,400)—a net increase of $250. While she would similar the checking residuum to grow each month, she realizes most of the August expenses were exceptional (brakes and insurance) and the insurance, in particular, was an unusually large expense. She is convinced the checking account balance will likely grow more in September considering she will earn coin from some new customers; she also anticipates having fewer expenses.

The Income Statement can also exist visualized by the formula: Acquirement – Expenses = Cyberspace Income/(Loss).

Let's change this example slightly and assume the $1,000 payment to the insurance company will be paid in September, rather than in August. In this case, the catastrophe rest in Chris's checking account would exist $i,250, a consequence of earning $ane,400 and only spending $100 for the brakes on her automobile and $50 for fuel. This stream of cash flows is an example of cash basis accounting because it reflects when payments are received and made, not necessarily the time period that they affect. At the end of this section and in The Adjustment Process yous will address accrual accounting, which does reflect the time period that they impact.

In accounting, this instance illustrates an income statement, a financial statement that is used to measure the financial functioning of an organization for a particular catamenia of time. We use the uncomplicated landscaping account example to discuss the elements of the income argument, which are revenues, expenses, gains, and losses. Together, these decide whether the organization has cyberspace income (where revenues and gains are greater than expenses and losses) or net loss (where expenses and losses are greater than revenues and gains). Revenues, expenses, gains, and losses are further defined hither.

Acquirement

Revenue i is the value of goods and services the organization sold or provided to customers for a given menstruum of time. In our current instance, Chris's landscaping concern, the "revenue" earned for the calendar month of Baronial would be $i,400. It is the value Chris received in exchange for the services provided to her clients. Likewise, when a business provides goods or services to customers for cash at the time of the service or in the future, the business classifies the corporeality(s) equally revenue. Simply every bit the $1,400 earned from a business made Chris'south checking account rest increase, revenues increase the value of a business organisation. In bookkeeping, revenues are often also called sales or fees earned. Merely as earning wages from a business organisation or summer job reflects the number of hours worked for a given rate of pay or payments from clients for services rendered, revenues (and the other terms) are used to indicate the dollar value of appurtenances and services provided to customers for a given flow of time.

Coffee Store Products

Think nearly the coffee shop in your area. Place items the java shop sells that would be classified as revenues. Remember, revenues for the java shop are related to its primary purpose: selling coffee and related items. Or, amend yet, make a trip to the local java store and get a outset-hand experience.

Solution

Many coffee shops earn revenue through multiple revenue streams, including coffee and other specialty drinks, nutrient items, gift cards, and merchandise.

Expenses

An expense 2 is a toll associated with providing appurtenances or services to customers. In our opening example, the expenses that Chris incurred totaled $ane,150 (consisting of $100 for brakes, $50 for fuel, and $one,000 for insurance). You might retrieve of expenses as the opposite of revenue in that expenses reduce Chris'southward checking business relationship balance. Likewise, expenses subtract the value of the business and stand for the dollar value of costs incurred to provide goods and services to customers for a given period of time.

Java Shop Expenses

While thinking near or visiting the coffee shop in your area, look around (or visualize) and identify items or activities that are the expenses of the java shop. Call back, expenses for the java shop are related to resources consumed while generating revenue from selling java and related items. Do non forget about any expenses that might not exist so obvious—as a general rule, every activity in a business has an associated cost.

Solution

Costs of the coffee shop that might be readily observed would include hire; wages for the employees; and the cost of the coffee, pastries, and other items/merchandise that may be sold. In addition, costs such every bit utilities, equipment, and cleaning or other supplies might likewise be readily observable. More obscure costs of the coffee store would include insurance, regulatory costs such equally health section licensing, point-of-sale/credit card costs, advertisement, donations, and payroll costs such as workers' bounty, unemployment, and then on.

Gains

A gain 3 can result from selling coincident business organisation items for more than than the items are worth. (Ancillary business items are those that are used to support business operations.) To illustrate the concept of a gain, permit'south return to our example. However, this example and the accompanying losses example are not going to exist part of our income statement, residuum canvas, or owner'southward disinterestedness statement discussions. The gains and losses examples are simply to be used in demonstrating the concepts of gains and losses. Presume that Chris paid $1,500 for a small-scale slice of property to utilize for building a storage facility for her company. Further assume that Chris has an opportunity to sell the land for $two,000. She subsequently plant a ameliorate storage selection and decided to sell the property. Later on doing then, Chris will take a proceeds of $500 (a selling price of $2,000 and a price of $1,500) and will also have $2,000 to deposit into her checking business relationship, which would increase the residue.

Thinking back to the gain ($i,400) Chris received from her landscaping business, we might inquire the question: how are gains similar to and different from revenues? The acquirement of $1,400 that Chris earned from her business concern and the $2,000 she received from selling the land are similar in that both increment her checking account balance and make her business more valuable.

A difference, however, is evident if we consider how these funds were earned. Chris earned the $1,400 because she provided services (her labor) to her clients. Chris's main objective is to earn revenue past working for her clients. In add-on, earning coin by selling her land was an exceptional event for Chris, since her primary job was serving every bit a landscaper. Her primary goal is to earn fees or revenue, not to earn coin past selling state. In fact, she cannot consider doing that once more because she does not have additional land to sell.

The primary goal of a business concern is to earn revenue past providing goods and services to customers in exchange for cash at that time or in the futurity. While selling other items for more than the value of the item does occur in business organization, these transactions are classified every bit gains, because these sales are infrequent and not the master purpose of the business.

Losses

A loss 4 results from selling coincident business items for less than the items are worth. To illustrate, permit's at present assume that Chris sells her state that she purchased for $1,500 at a sales price of $1,200. In this case she would realize (incur) a loss of $300 on the auction of the property ($1,200 sales toll minus the $1,500 cost of purchasing the belongings) and volition also have $one,200 to eolith into her checking account, which would increase the residual.

Yous should not be confused by the fact that the checking account remainder increased even though this transaction resulted in a financial loss. Chris received $i,200 that she tin can eolith into her checking business relationship and utilize for future expenses. The $300 loss simply indicates that she received less for the state than she paid for it. These are two aspects of the same transaction that communicate different things, and it is important to sympathise the differences.

Every bit we saw when comparing gains and revenues, losses are similar to expenses in that both losses and expenses subtract the value of the system. In addition, just as Chris's master goal is to earn money from her job rather than selling land, in business, losses refer to exceptional transactions involving ancillary items of the concern.

Internet Income (Cyberspace Loss)

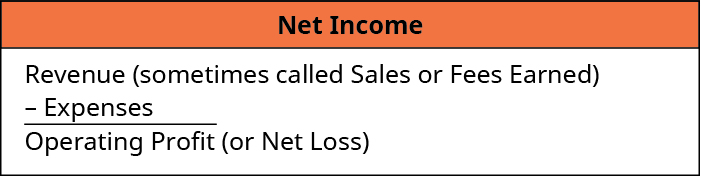

Net income (internet loss) is adamant past comparing revenues and expenses. Cyberspace income is a result of revenues (inflows) being greater than expenses (outflows). A internet loss occurs when expenses (outflows) are greater than revenues (inflows). In accounting it is mutual to nowadays net income in the following format:

Recall that revenue is the value of goods and services a business provides to its customers and increase the value of the business. Expenses, on the other mitt, are the costs of providing the goods and services and decrease the value of the business concern. When revenues exceed expenses, companies take net income. This means the business has been successful at earning revenues, containing expenses, or a combination of both. If, on the other hand, expenses exceed revenues, companies experience a net loss. This means the business was unsuccessful in earning adequate revenues, sufficiently containing expenses, or a combination of both. While businesses piece of work difficult to avoid internet loss situations, it is not uncommon for a company to sustain a net loss from time-to-fourth dimension. Information technology is difficult, however, for businesses to remain viable while experiencing net losses over the long term.

Shown as a formula, the net income (loss) function is:

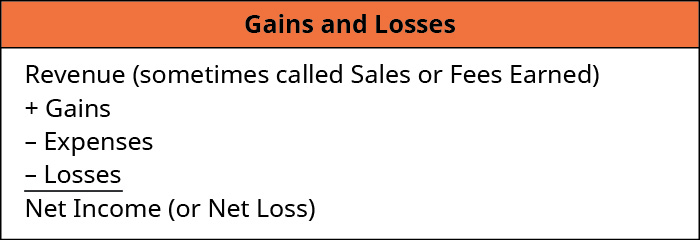

To be complete, we must also consider the impact of gains and losses. While gains and losses are infrequent in a concern, it is not uncommon that a business would nowadays a gain and/or loss in its financial statements. Recall that gains are similar to revenue and losses are similar to expenses. Therefore, the traditional accounting format would exist:

Shown as a formula, the net income (loss) role, including gains and losses, is:

![Two equations are shown. Revenues (R) plus Gains (G) minus Expenses (E) minus Losses (L) equals Net Income [when (R plus G) is greater than (E plus L)]. Revenues (R) plus Gains (G) minus Expenses (E) minus Losses (L) equals Net Income [when (E plus L) is greater than (R plus G)].](https://opentextbc.ca/principlesofaccountingv1openstax/wp-content/uploads/sites/267/2019/07/OSX_Acct_F02_01_GandL02_img.jpg)

When assessing a company'southward net income, it is of import to sympathize the source of the internet income. Businesses strive to reach "loftier-quality" net income (earnings). Loftier-quality earnings are based on sustainable earnings—too called permanent earnings—while relying less on exceptional earnings—also chosen temporary earnings. Recall that revenues represent the ongoing value of appurtenances and services the concern provides (sells) to its customers, while gains are exceptional and involve items ancillary to the principal purpose of the business. We should use circumspection if a concern attains a significant portion of its net income as a issue of gains, rather than revenues. Likewise, net losses derived every bit a result of losses should be put into the proper perspective due to the infrequent nature of losses. While cyberspace losses are undesirable for any reason, cyberspace losses that event from expenses related to ongoing operations, rather than losses that are exceptional, are more concerning for the business.

Statement of Possessor's Disinterestedness

Equity is a term that is often confusing but is a concept with which you are probably already familiar. In brusk, equity is the value of an item that remains later considering what is owed for that item. The post-obit example may help illustrate the concept of disinterestedness.

When thinking about the concept of equity, it is often helpful to think well-nigh an example many families are familiar with: purchasing a habitation. Suppose a family purchases a home worth $200,000. Subsequently making a down payment of $25,000, they secure a bank loan to pay the remaining $175,000. What is the value of the family unit'due south equity in the home? If you answered $25,000, you are correct. At the time of the purchase, the family unit owns a dwelling house worth $200,000 (an nugget), but they owe $175,000 (a liability), so the equity or net worth in the home is $25,000.

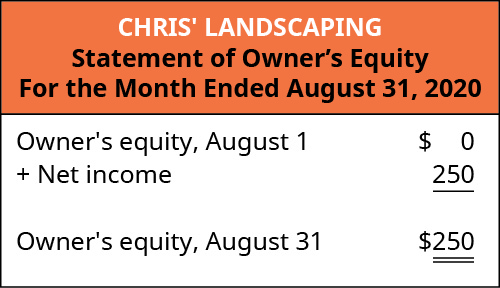

The statement of possessor's equity, which is the second fiscal argument created by accountants, is a statement that shows how the equity (or value) of the organization has changed over time. Similar to the income statement, the argument of possessor's equity is for a specific period of fourth dimension, typically one year. Recall that another way to recall nearly equity is net worth, or value. And then, the statement of possessor'due south equity is a financial statement that shows how the net worth, or value, of the business organization has changed for a given flow of fourth dimension.

The elements of the financial statements shown on the statement of owner'southward equity include investments past owners as well as distributions to owners. Investments by owners and distributions to owners are 2 activities that impact the value of the organization (increase and decrease, respectively). In addition, net income or net loss affects the value of the organization (net income increases the value of the system, and net loss decreases it). Net income (or net loss) is also shown on the argument of owner's disinterestedness; this is an example of how the statements are interrelated. Note that the word owner's (singular for a sole owner) changes to owners' (plural, for a group of owners) when preparing this argument for an entity with multiple owners versus a sole proprietorship.

In our example, to make information technology less complicated, we started with the starting time calendar month of operations for Chris'due south Landscaping. In the get-go calendar month of operations, the owner'due south disinterestedness total begins the calendar month of August 2020, at $0, since at that place have been no transactions. During the calendar month, the business received revenue of $ane,400 and incurred expenses of $1,150, for internet income of $250. Since Chris did not contribute whatsoever investment or brand any withdrawals, other than the $one,150 for expenses, the ending balance in the owner'due south equity business relationship on August 31, 2020, would be $250, the net income earned.

At this stage, information technology's important to point out that we are working with a sole proprietorship to help simplify the examples. We accept addressed the possessor's value in the firm as capital or owner'south equity. Yet, afterward we switch the construction of the business to a corporation, and instead of owner'due south disinterestedness nosotros begin using stockholder's disinterestedness, which includes account titles such as common stock and retained earnings to represent the owners' interests.

The corporate treatment is more than complicated because corporations may have a few owners up to potentially thousands of owners (stockholders). More than particular on this consequence is provided in Ascertain, Explain, and Provide Examples of Electric current and Noncurrent Avails, Current and Noncurrent Liabilities, Disinterestedness, Revenues, and Expenses.

Investments by Owners

Mostly, there are two ways by which organizations become more valuable: profitable operations (when revenues exceed expenses) and investments by owners. Organizations often have long-term goals or projects that are very expensive (for example, building a new manufacturing facility or purchasing another company).

While having assisting operations is a viable fashion to "fund" these goals and projects, organizations ofttimes want to undertake these projects in a quicker time frame. Selling ownership is one way to quickly obtain the funding necessary for these goals. Investments by owners represent an exchange of cash or other avails for which the investor is given an buying involvement in the organisation. This is a mutually beneficial organization: the organization gets the funding it needs on a timely basis, and the investor gets an buying interest in the arrangement.

When organizations generate funding past selling ownership, the ownership interest unremarkably takes the form of common stock, which is the corporation'south primary class of stock issued, with each share representing a fractional merits to ownership or a share of the company'due south concern. When the organization issues common stock for the start time, information technology is called an initial public offering (IPO). In Corporation Accounting, y'all learn more about the specifics of this blazon of accounting. Once a company issues (or sells) mutual stock afterward an IPO, we describe the company as a publicly traded company, which only means the company's stock tin can exist purchased past the general public on a public exchange like the New York Stock Substitution (NYSE). That is, investors can become owners of the particular company. Companies that issue publicly traded mutual shares in the Us are regulated past the Securities and Exchange Committee (SEC), a federal regulatory agency that, amid other responsibilities, is charged with oversight of fiscal investments such equally mutual stock.

Roku Goes Public

On September 1, 2017, Roku, Inc. filed a Grade Due south-1 with the Securities and Exchange Committee (SEC).5 In this form, Roku disclosed its intention to become a publicly traded visitor, meaning its stock will trade (sell) on public stock exchanges, allowing private and institutional investors an opportunity to ain a portion (shares) of the visitor. The Course S-1 included detailed financial and nonfinancial information most the company. The information from Roku likewise included the purpose of the offering as well every bit the intended uses of the funds. Here is a portion of the disclosure: "The primary purposes of this offer are to increase our capitalization and financial flexibility and create a public market for our Form A common stock. We intend to use the net gain we receive from this offer primarily for full general corporate purposes, including working majuscule . . . enquiry and development, concern development, sales and marketing activities and upper-case letter expenditures."6

On September 28, 2017, Roku "went public" and exceeded expectations. Prior to the IPO, Roku estimated it would sell between $12 and $fourteen per share, raising over $117 one thousand thousand for the company. The closing price per share on September 28 was $23.50, near doubling initial expectations for the share value.7

Distributions to Owners

There are basically two ways in which organizations go less valuable in terms of owners' equity: from unprofitable operations (when expenses or losses exceed revenues or gains) and by distributions to owners. Owners (investors) of an system desire to see their investment appreciate (gain) in value. Over time, owners of common stock can see the value of the stock increase in value—the share price increases—due to the success of the system. Organizations may also make distributions to owners, which are periodic rewards issued to the owners in the form of cash or other avails. Distributions to owners represent some of the value (equity) of the organization.

For investors who hold common stock in the organization, these periodic payments or distributions to owners are called dividends. For sole proprietorships, distributions to owners are withdrawals or drawings. From the organisation'southward perspective, dividends represent a portion of the net worth (equity) of the organization that is returned to owners every bit a reward for their investment. While issuing dividends does, in fact, reduce the system's assets, some argue that paying dividends increases the organisation'due south long-term value by making the stock more desirable. (Annotation that this topic falls nether the category of "dividend policy" and there is a meaning stream of research addressing this.)

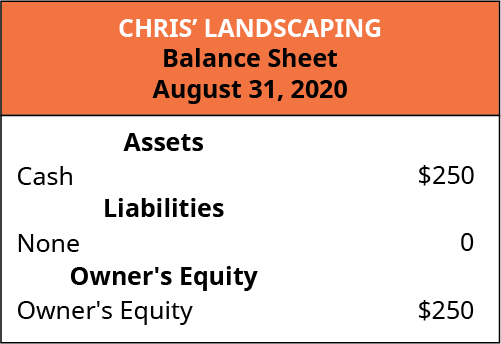

Balance Sheet

In one case the statement of owner'southward disinterestedness is completed, accountants typically complete the residuum sheet, a argument that lists what the organization owns (assets), what it owes (liabilities), and what information technology is worth (equity) on a specific date. Find the change in timing of the report. The income statement and argument of possessor'south equity report the financial performance and equity change for a menstruation of time. The balance sheet, however, lists the financial position at the close of business organization on a specific appointment. (Refer to (Effigy) for the remainder sheet as of August 31, 2020, for Chris' Landscaping.)

"Balance Canvas for Chris' Landscaping." (attribution: Copyright, Rice University, OpenStax, under CC By-NC-SA four.0 license)

Avails

If y'all recall our previous case involving Chris and her newly established landscaping business, y'all are probably already familiar with the term asset 8—these are resource used to generate revenue. In Chris'due south business organisation, to keep the example relatively uncomplicated, the business ended the calendar month with one asset, greenbacks, bold that the insurance was for one month's coverage.

However, equally organizations become more than complex, they oftentimes have dozens or more types of assets. An asset can be categorized as a brusk-term asset or electric current nugget (which is typically used up, sold, or converted to cash in i year or less) or as a long-term asset or noncurrent nugget (which is not expected to exist converted into cash or used up within one twelvemonth). Long-term assets are oftentimes used in the production of products and services.

Examples of short-term avails that businesses own include cash, accounts receivable, and inventory, while examples of long-term assets include land, mechanism, office article of furniture, buildings, and vehicles. Several of the chapters that you volition study are dedicated to an in-depth coverage of the special characteristics of selected assets. Examples include Merchandising Transactions, which are typically short term, and Long-Term Avails, which are typically long term.

An asset tin likewise be categorized as a tangible asset or an intangible asset. Tangible assets have a physical nature, such as trucks or many inventory items, while intangible assets have value just often lack a physical existence or corpus, such every bit insurance policies or trademarks.

Liabilities

You are also probably already familiar with the term liability 9—these are amounts owed to others (chosen creditors). A liability can likewise exist categorized as a short-term liability (or current liability) or a long-term liability (or noncurrent liability), similar to the treatment accorded assets. Short-term liabilities are typically expected to be paid inside one year or less, while long-term liabilities are typically expected to be due for payment more than one year past the current balance canvass date.

Common short-term liabilities or amounts owed past businesses include amounts owed for items purchased on credit (too called accounts payable), taxes, wages, and other business costs that will be paid in the futurity. Long-term liabilities can include such liabilities as long-term notes payable, mortgages payable, or bonds payable.

Equity

In the Argument of Owner's Disinterestedness give-and-take, y'all learned that disinterestedness (or net assets) refers to book value or net worth. In our example, Chris's Landscaping, we determined that Chris had $250 worth of equity in her company at the end of the beginning month (come across (Figure)).

At any point in time it is of import for stakeholders to know the financial position of a business organisation. Stated differently, it is important for employees, managers, and other interested parties to understand what a business owns, owes, and is worth at any given point. This provides stakeholders with valuable financial information to make decisions related to the business.

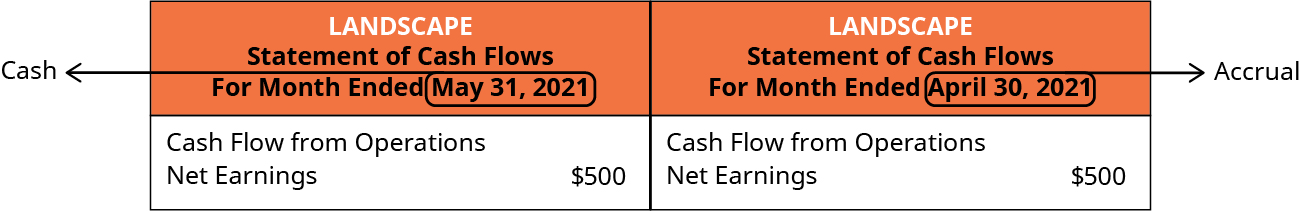

Statement of Greenbacks Flows

The fourth and final fiscal statement prepared is the statement of greenbacks flows, which is a statement that lists the greenbacks inflows and cash outflows for the business for a period of time. At first glance, this may seem like a redundant financial argument. We know the income argument besides reports the inflows and outflows for the business for a flow of time. In addition, the statement of owner's equity and the balance sheet help to show the other activities, such every bit investments by and distributions to owners that are non included in the income statement. To empathize why the statement of greenbacks flows is necessary, we must first sympathise the two bases of accounting used to prepare the financial statements. The changes in cash within this argument are often referred to as sources and uses of cash. A source of cash lets one see where cash is coming from. For example, is cash being generated from sales to customers, or is the greenbacks a result of an advance in a large loan. Apply of cash looks at what cash is being used for. Is cash being used to brand an involvement payment on a loan, or is cash beingness used to purchase a large slice of machinery that will expand business organisation capacity? The two bases of bookkeeping are the greenbacks basis and the accrual basis, briefly introduced in Describe the Income Statement, Statement of Owner'south Equity, Residuum Canvass, and Statement of Cash Flows, and How They Interrelate.

Nether greenbacks basis bookkeeping, transactions (i.e., a sale or a buy) are non recorded in the financial statements until at that place is an exchange of greenbacks. This type of accounting is permitted for nonprofit entities and minor businesses that elect to use this blazon of accounting. Under accrual basis bookkeeping, transactions are generally recorded in the financial statement when the transactions occur, and non when paid, although in some situations the two events could happen on the same solar day.

An case of the two methods (cash versus accrual accounting) would probably help clarify their differences. Presume that a mechanic performs a tune-up on a customer's automobile on May 29, and the customer picks upwardly her car and pays the mechanic $100 on June 2. If the mechanic were using the cash method, the acquirement would be recognized on June 2, the engagement of payment, and any expenses would be recognized when paid.

If the accrual method were used, the mechanic would recognize the revenue and any related expenses on May 29, the solar day the work was completed. The accrual method will be the ground for your studies hither (except for our coverage of the cash flow statement in Statement of Cash Flows). The accrual method is besides discussed in greater particular in Explicate the Steps within the Accounting Cycle through the Unadjusted Trial Balance.

While the cash basis of accounting is suited well and is more efficient for small-scale businesses and certain types of businesses, such every bit farming, and those without inventory, like lawyers and doctors, the accrual ground of accounting is theoretically preferable to the cash ground of accounting. Accrual accounting is advantageous because information technology distinguishes betwixt the timing of the transactions (when goods and services are provided) and when the cash involved in the transactions is exchanged (which can be a significant amount of fourth dimension after the initial transaction). This allows accountants to provide, in a timely mode, relevant and complete information to stakeholders. The Adjustment Process explores several common techniques involved in accrual bookkeeping.

2 brief examples may aid illustrate the divergence betwixt greenbacks accounting and accrual accounting. Assume that a business sells $200 worth of merchandise. In some businesses, at that place are two means the customers pay: cash and credit (also referred to every bit "on account"). Cash sales include checks and credit cards and are paid at the time of the sale. Credit sales (not to be confused with credit card sales) allow the customer to have the merchandise simply pay inside a specified menstruum of time, usually upward to xl-five days.

A cash auction would be recorded in the financial statements under both the greenbacks basis and accrual ground of accounting. It makes sense because the customer received the trade and paid the business at the same fourth dimension. It is considered two events that occur simultaneously (exchange of merchandise for cash).

Similar to the previous instance for the mechanic, a credit sale, however, would be treated differently nether each of these types of accounting. Nether the greenbacks basis of accounting, a credit sale would not be recorded in the financial statements until the cash is received, nether terms stipulated past the seller. For example, assume on April 1 a landscaping business provides $500 worth of services to i of its customers. The sale is fabricated on account, with the payment due forty-v days afterward. Under the cash ground of accounting, the revenue would non be recorded until May 16, when the cash was received. Under the accrual basis of accounting, this sale would be recorded in the fiscal statements at the time the services were provided, Apr 1. The reason the sale would be recorded is, nether accrual accounting, the business reports that it provided $500 worth of services to its client. The fact the customers will pay later is viewed as a divide transaction nether accrual accounting ((Figure)).

Credit versus Cash. On the left is a credit sale recorded under the cash footing of accounting. On the correct the same credit auction is recorded nether the accrual basis of bookkeeping. (attribution: Copyright Rice Academy, OpenStax, nether CC BY-NC-SA 4.0 license)

Let's at present explore the difference between the cash basis and accrual basis of accounting using an expense. Presume a business purchases $160 worth of printing supplies from a supplier (vendor). Like to a auction, a purchase of merchandise can be paid for at the time of sale using cash (too a cheque or credit card) or at a later date (on account). A purchase paid with cash at the time of the sale would be recorded in the financial statements nether both cash footing and accrual basis of accounting. Information technology makes sense because the business organization received the printing supplies from the supplier and paid the supplier at the same time. It is considered ii events that occur simultaneously (exchange of merchandise for cash).

If the purchase was fabricated on account (also called a credit purchase), however, the transaction would be recorded differently under each of these types of accounting. Under the cash basis of accounting, the $160 purchase on account would not be recorded in the financial statements until the cash is paid, as stipulated by the seller's terms. For case, if the printing supplies were received on July 17 and the payment terms were fifteen days, no transaction would be recorded until August 1, when the goods were paid for. Under the accrual footing of bookkeeping, this purchase would exist recorded in the fiscal statements at the fourth dimension the business received the printing supplies from the supplier (July 17). The reason the purchase would be recorded is that the business reports that information technology bought $160 worth of press supplies from its vendors. The fact the concern will pay later is viewed as a separate issue under accrual bookkeeping. (Effigy) summarizes these examples under the different bases of accounting.

| Transactions past Cash Basis versus Accrual Basis of Accounting | ||

|---|---|---|

| Transaction | Nether Greenbacks Ground Accounting | Under Accrual Footing Bookkeeping |

| $200 sale for cash | Recorded in fiscal statements at time of sale | Recorded in financial statements at time of sale |

| $200 sale on account | Non recorded in financial statements until cash is received | Recorded in financial statements at fourth dimension of auction |

| $160 purchase for cash | Recorded in financial statements at fourth dimension of purchase | Recorded in financial statements at fourth dimension of purchase |

| $160 purchase on business relationship | Non recorded in financial statements until cash is paid | Recorded in fiscal statements at time of buy |

Knowing the difference between the cash basis and accrual basis of accounting is necessary to understand the demand for the statement of cash flows. Stakeholders demand to know the financial functioning (as measured past the income argument—that is, cyberspace income or cyberspace loss) and financial position (every bit measured by the residue sheet—that is, assets, liabilities, and owners' equity) of the business. This information is provided in the income statement, argument of owner's equity, and residual sheet. Nonetheless, since these financial statements are prepared using accrual accounting, stakeholders do not have a clear moving picture of the business's cash activities. The argument of cash flows solves this inadequacy by specifically focusing on the cash inflows and cash outflows.

Cardinal Concepts and Summary

- Financial statements provide financial information to stakeholders to help them in making decisions.

- There are 4 financial statements: income statement, argument of possessor's equity, residuum sail, and argument of cash flows.

- The income statement measures the financial performance of the organization for a period of time. The income statement lists revenues, expenses, gains, and losses, which brand up internet income (or cyberspace loss).

- The statement of owner's equity shows how the net worth of the organisation changes for a menstruation of time. In addition to showing cyberspace income or net loss, the statement of possessor's equity shows the investments by and distributions to owners.

- The balance sheet shows the organization's financial position on a given date. The residual sheet lists assets, liabilities, and owners' equity.

- The statement of cash flows shows the system's greenbacks inflows and cash outflows for a given catamenia of time. The statement of greenbacks flows is necessary because financial statements are usually prepared using accrual accounting, which records transactions when they occur rather than waiting until greenbacks is exchanged.

Multiple Choice

(Figure)Which of these statements is not one of the financial statements?

- income argument

- residue sail

- statement of cash flows

- statement of owner investments

(Figure)Stakeholders are less likely to include which of the post-obit groups?

- owners

- employees

- customs leaders

- competitors

(Figure)Identify the correct components of the income argument.

- revenues, losses, expenses, and gains

- assets, liabilities, and possessor'south equity

- revenues, expenses, investments by owners, distributions to owners

- avails, liabilities, and dividends

(Figure)The residuum sheet lists which of the following?

- assets, liabilities, and owners' equity

- revenues, expenses, gains, and losses

- assets, liabilities, and investments by owners

- revenues, expenses, gains, and distributions to owners

(Figure)Presume a company has a $350 credit (not cash) sale. How would the transaction announced if the business uses accrual accounting?

- $350 would show upwards on the residual sheet every bit a auction.

- $350 would testify upwards on the income statement as a sale.

- $350 would prove up on the statement of cash flows as a cash outflow.

- The transaction would not exist reported because the cash was not exchanged.

Questions

(Figure)Identify the four fiscal statements and depict the purpose of each.

Income statement shows the financial performance of a business concern for a menstruation of time; statement of owner's equity shows the change in net worth of a business for a period of time; balance sheet shows the financial position of a business organisation on a specific appointment; argument of cash flows shows the greenbacks inflows and outflows of the business organization for a menstruation of time.

(Figure)Ascertain the term stakeholders. Place ii stakeholder groups, and explicate how each group might use the data contained in the financial statements.

(Figure)Identify 1 similarity and one difference between revenues and gains. Why is this distinction of import to stakeholders?

Both revenues and gains represent inflows to the business, making information technology more valuable. Revenues relate to the primary purpose of the business, while gains represent incidental or peripheral activities. This is important to stakeholders because revenues stand for ongoing or permanent activities, while gains correspond infrequent or transient activities. Stakeholders should focus on permanent earnings and put peripheral or incidental earnings into the proper context.

(Figure)Identify one similarity and 1 difference betwixt expenses and losses. Why is this distinction important to stakeholders?

(Effigy)Explain the concept of equity, and place some activities that affect equity of a business.

Equity is the internet worth of the business concern. Information technology can too be thought of as the net assets (assets minus liabilities) of the business. Activities that affect equity include revenues, expenses, gains, losses, and investment by and distributions to owners.

Exercise Prepare A

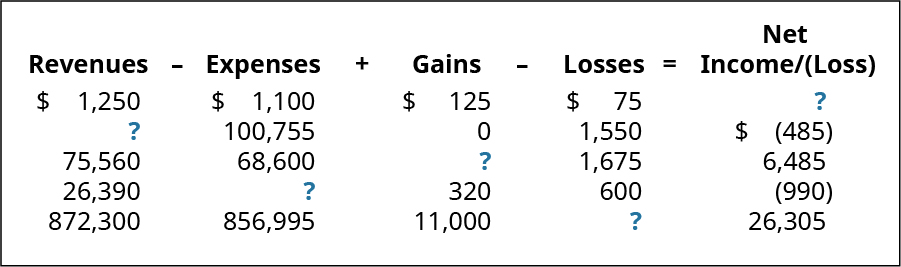

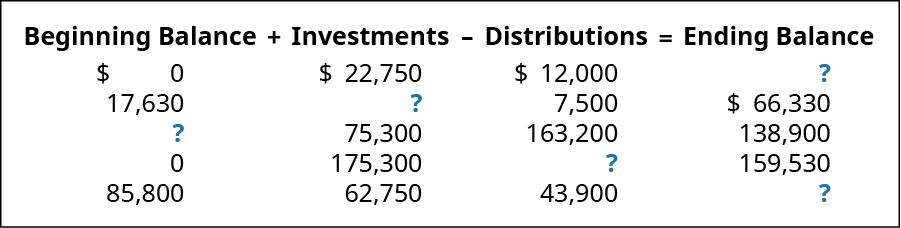

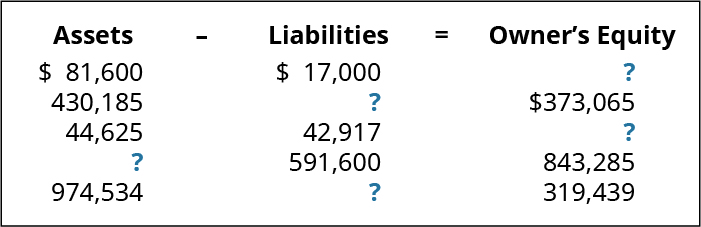

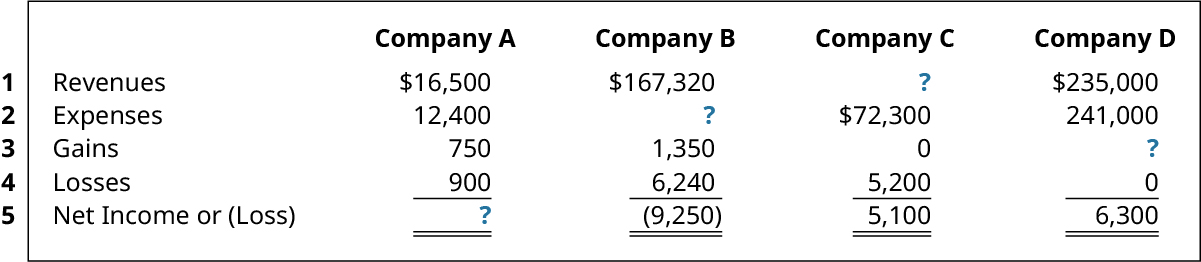

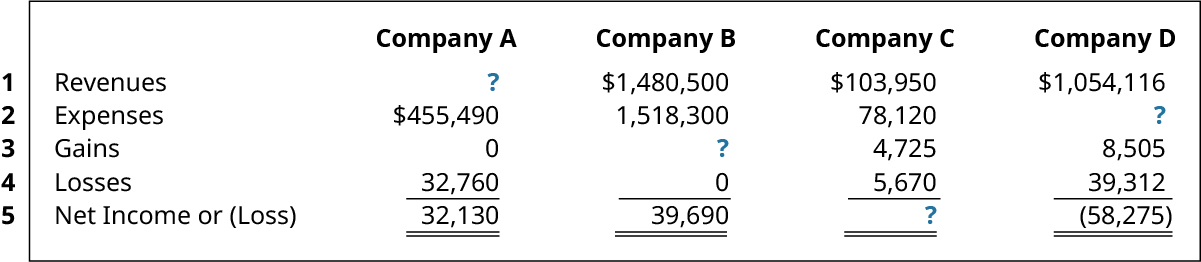

(Figure)For each independent situation below, summate the missing values.

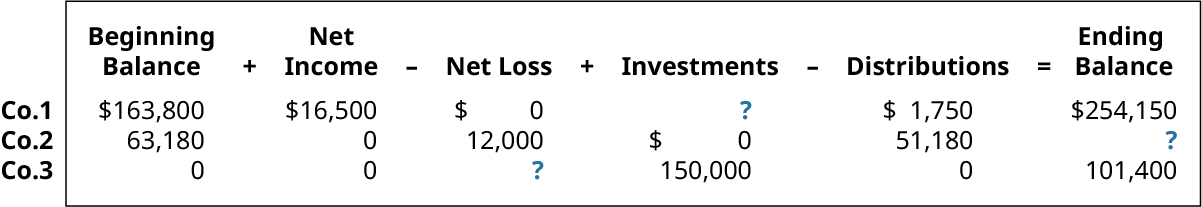

(Figure)For each contained situation below, calculate the missing values for owner'due south equity

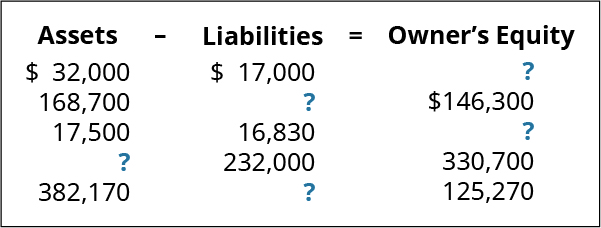

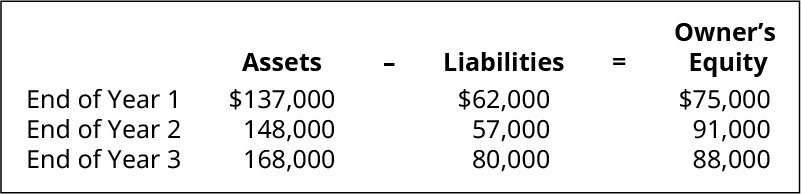

(Effigy)For each independent state of affairs beneath, summate the missing values.

(Figure)For each independent situation below, place an (10) past the transactions that would be included in the argument of cash flows.

| Transaction | Included |

|---|---|

| Sold items on account | |

| Wrote check to pay utilities | |

| Received cash investment by owner | |

| Recorded wages owed to employees | |

| Received beak for advertising | |

Exercise Ready B

(Effigy)For each independent situation below, calculate the missing values.

(Effigy)For each independent situation beneath, calculate the missing values for Owner's Disinterestedness.

(Effigy)For each independent state of affairs beneath, summate the missing values.

(Figure)For each of the following independent situations, identify an (X) by the transactions that would be included in the argument of cash flows.

| Transaction | Included |

|---|---|

| Purchased supplies with check | |

| Received inventory (a neb was included) | |

| Paid greenbacks to possessor for withdrawal | |

| Gave cash donation to local charity | |

| Received bill for utilities | |

Problem Set A

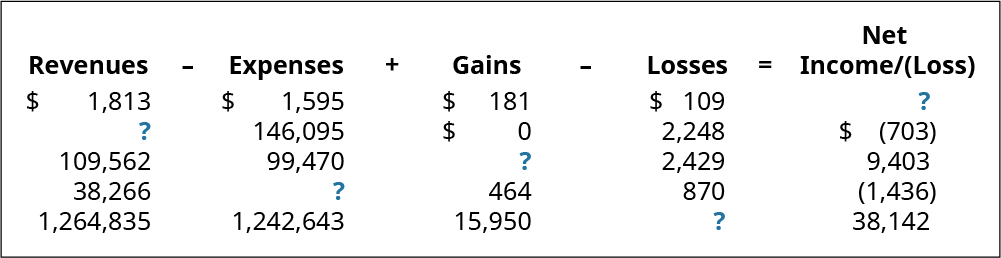

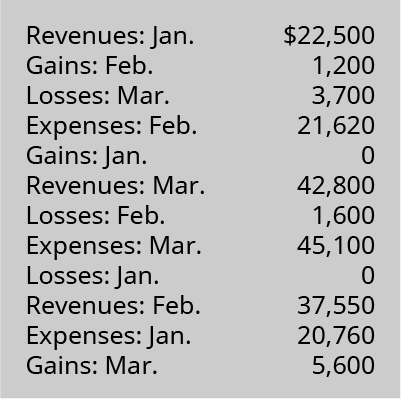

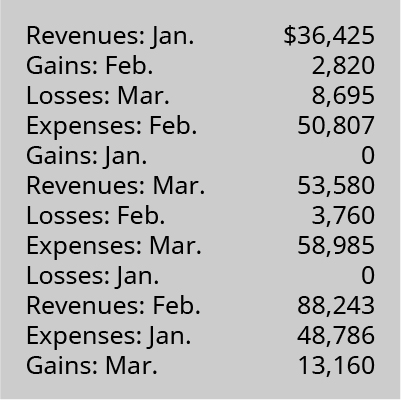

(Figure)The following information is taken from the records of Baklava Baker for the year 2019.

- Calculate internet income or net loss for January.

- Summate cyberspace income or net loss for February.

- Calculate net income or net loss for March.

- For each state of affairs, comment on how a stakeholder might view the business firm's performance. (Hint: Recall about the source of the income or loss.)

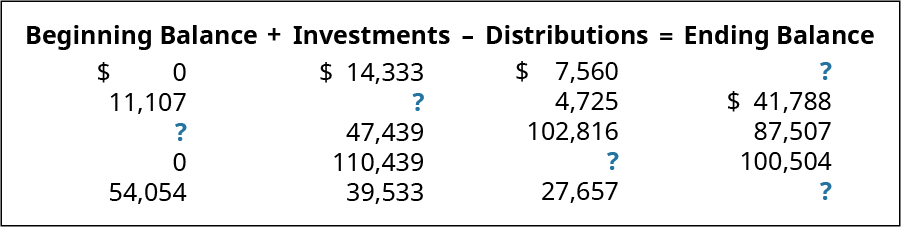

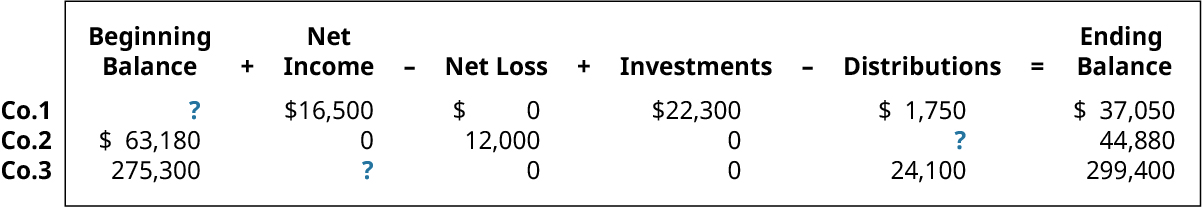

(Figure)Each situation below relates to an independent visitor's owners' equity.

- Calculate the missing values.

- Based on your calculations, brand observations about each company.

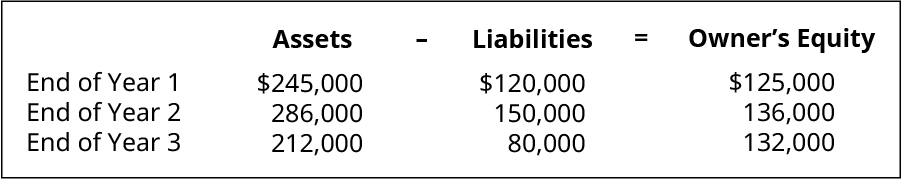

(Figure)The post-obit information is from a new business. Comment on the year-to-yr changes in the accounts and possible sources and uses of funds (how were the funds obtained and used).

(Figure)Each of the post-obit situations relates to a different company.

- For each of these contained situations, find the missing amounts.

- How would stakeholders view the financial performance of each company? Explain.

Problem Set B

(Figure)The following information is taken from the records of Rosebloom Flowers for the twelvemonth 2019.

- Calculate net income or net loss for January.

- Summate net income or cyberspace loss for February.

- Calculate net income or net loss for March.

- For each situation, comment on how a stakeholder might view the firm's performance. (Hint: remember virtually the source of the income or loss.)

(Effigy)Each state of affairs beneath relates to an contained company'due south Owners' Equity.

- Calculate the missing values.

- Based on your calculations, make observations virtually each company.

(Figure)The post-obit information is from a new business. Comment on the twelvemonth-to-year changes in the accounts and possible sources and uses funds (how were the funds obtained and used).

(Figure)Each of the following situations relates to a different company.

- For each of these independent situations, find the missing amounts.

- How would stakeholders view the financial performance of each company? Explain.

Thought Provokers

(Figure)Choose three stakeholders (or stakeholder groups) for Walmart and prepare a written response for each stakeholder. In your written response, consider the factors nearly the business organization the detail stakeholder would be interested in. Consider the financial and any nonfinancial factors that would be relevant to the stakeholder (or stakeholder group). Explain why these factors are of import. Do some enquiry and see if you lot tin can find support for your points.

(Effigy)Presume y'all purchased ten shares of Roku during the company's IPO. Comment on why this might be a expert investment. Consider factors such as what you expect to get from your investment, why you think Roku would become a publicly traded company, and what you think is the landscape of the industry Roku is in. What other factors might be relevant to your decision to invest in Roku?

Footnotes

- 1 In a subsequent department of this affiliate, yous will learn that the accounting profession is governed by the Financial Accounting Standards Board (or FASB), a professional body that bug guidelines/pronouncements for the bookkeeping profession. A set of theoretical pronouncements issued past FASB is chosen Statement of Financial Accounting Concepts (SFAC). In SFAC No. six, FASB defines revenues as "inflows or other enhancements of assets of an entity or settlements of its liabilities (or a combination of both) from delivering or producing goods, rendering services, or other activities that constitute the entity's ongoing major or central operations" (SFAC No. 6, p. 23).

- ii Expenses are formally defined by the FASB as "outflows or other using upward of assets or incurrences of liabilities (or a combination of both) from delivering or producing goods, rendering services, or carrying out other activities that plant the entity'south ongoing major or cardinal operations" (SFAC No. half dozen, p. 23).

- 3 FASB notes that gains represent an increase in organizational value from activities that are "incidental or peripheral" (SFAC No. half dozen, p. 24) to the primary purpose of the business.

- 4 FASB notes losses represent a decrease in organizational value from activities that are "incidental or peripheral" (SFAC No. 6, p. 24) to the primary purpose of the business.

- 5 Roku, Inc. "Form Due south-ane Filing with the Securities and Exchange Commission." September one, 2017. https://www.sec.gov/Archives/edgar/data/1428439/000119312517275689/d403225ds1.htm

- 6 Roku, Inc. "Form S-ane Filing with the Securities and Commutation Commission." September 1, 2017. https://www.sec.gov/Archives/edgar/data/1428439/000119312517275689/d403225ds1.htm

- seven Roku, Inc. Data. https://finance.yahoo.com/quote/ROKU/history?p=ROKU

- 8 The FASB defines avails as "probable future economic benefits obtained or controlled past a item entity as a event of past transactions or events" (SFAC No. six, p. 12).

- 9 The FASB defines liabilities as "probable futurity sacrifices of economic benefits arising from nowadays obligations of a detail entity to transfer assets or provide services to other entities in the futurity as a effect of past transactions or events" (SFAC No. 6, p. xiii).

Glossary

- accrual basis accounting

- accounting system in which revenue is recorded or recognized when earned nevertheless non necessarily received, and in which expenses are recorded when legally incurred and not necessarily when paid

- asset

- tangible or intangible resources endemic or controlled past a company, individual, or other entity with the intent that it will provide economic value

- balance sheet

- financial statement that lists what the organization owns (avails), owes (liabilities), and is worth (equity) on a specific date

- cash basis accounting

- method of accounting in which transactions are not recorded in the financial statements until in that location is an exchange of cash

- mutual stock

- corporation'southward chief form of stock issued, with each share representing a partial claim to buying or a share of the visitor's business

- corporation

- legal business structure involving ane or more than individuals (owners) who are legally distinct (split up) from the business

- distribution to owner

- periodic "reward" distributed to possessor of greenbacks or other assets

- dividend

- portion of the net worth (equity) that is returned to owners of a corporation as a advantage for their investment

- equity

- residual interest in the assets of an entity that remains later deducting its liabilities

- expense

- cost associated with providing goods or services

- gain

- increase in organizational value from activities that are "incidental or peripheral" to the primary purpose of the business

- income statement

- financial statement that measures the organization's financial operation for a given catamenia of time

- initial public offering (IPO)

- when a company issues shares of its stock to the public for the first time

- intangible nugget

- asset with financial value but no physical presence; examples include copyrights, patents, goodwill, and trademarks

- investment past owner

- commutation of cash or other assets in exchange for an ownership interest in the organization

- liability

- probable future cede of economic benefits arising from nowadays obligations of a particular entity to transfer assets or provide services to other entities in the time to come equally a event of past transactions or events

- long-term asset

- asset used ongoing in the normal course of business for more i year that is not intended to exist resold

- long-term liability

- debt settled outside one year or ane operating bicycle, whichever is longer

- loss

- decrease in organizational value from activities that are "incidental or peripheral" to the principal purpose of the business concern

- net income

- when revenues and gains are greater than expenses and losses

- internet loss

- when expenses and losses are greater than revenues and gains

- partnership

- legal business concern structure consisting of an association of two or more than people who contribute money, holding, or services to operate as co-owners of a business organization

- publicly traded company

- visitor whose stock is traded (bought and sold) on an organized stock exchange

- acquirement

- inflows or other enhancements of assets of an entity or settlements of its liabilities (or a combination of both) from delivering or producing goods, rendering services, or other activities that constitute the entity's ongoing major or central operations

- Securities and Substitution Commission (SEC)

- federal regulatory agency that regulates corporations with shares listed and traded on security exchanges through required periodic filings

- short-term asset

- asset typically used up, sold, or converted to cash in one twelvemonth or less

- short-term liability

- liability typically expected to be paid within 1 year or less

- sole proprietorship

- legal business organisation structure consisting of a single individual

- stakeholder

- someone affected by decisions made by a company; may include an investor, creditor, employee, manager, regulator, client, supplier, and layperson

- statement of cash flows

- financial statement listing the greenbacks inflows and cash outflows for the business for a flow of fourth dimension

- statement of owner's disinterestedness

- financial statement showing how the equity of the organisation inverse for a period of time

- tangible asset

- asset that has physical substance

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/describe-the-income-statement-statement-of-owners-equity-balance-sheet-and-statement-of-cash-flows-and-how-they-interrelate/

Posted by: dickinsondifusest.blogspot.com

0 Response to "Are Investors Money Reflect In Income Statement"

Post a Comment